Fiscally

Responsible

Outcomes and Economic

Growth

Strategy

Federal-Provincial Fiscal Partnership

Canadians deserve and expect high-quality and timely public services in key areas such as health care, education and social services. For these expectations to be met, there must be a well-functioning federal-provincial transfer system to ensure Canadians can get access to the services they need, when they need it.These objectives are supported through the ‘major federal transfers’ system, which includes the Canada Health Transfer (CHT), the Canada Social Transfer (CST), Equalization (EQ) and Territorial Formula Financing (TFF). These programs are transfers of revenue from the federal government to individual provinces and territories.

The major federal transfers supplement provincial and territorial own-source revenues that support the funding of programs and public services in areas such as health care, education and social services. All provinces and territories receive the CHT and CST, and all provinces have received support from the EQ program at one time or another.

Because the major federal transfers are largely unconditional, they provide provinces and territories extensive flexibility to spend the funds in a manner that addresses the unique needs and challenges in that particular jurisdiction. Without adequate major federal transfers, provinces and territories would have little option but to reduce the level of services offered to residents, substantially increase taxes or increase borrowing.

While the federal government has sole authority to design and determine the level of funding in the major federal transfer programs, it is the provinces and territories that deliver the programs and services this funding supports. As such, co-operation and collaboration between the provinces, territories and the federal government are critical for ensuring that Canada’s fiscal arrangements are adequate, responsive and sustainable.

Since the mid-1990s, the federal government has taken several measures to reduce its overall contribution flowing through the major federal transfers. This has resulted in systemic pressures across provincial and territorial health care, education and social service systems to meet the diverse and growing needs of Canadians.

Manitoba is currently working with all of the other provinces and territories, through the Council of the Federation, to negotiate enhancements to the CHT that will represent a renewed and reinvigorated health care funding partnership with the federal government.

When the major federal transfers are adequate, responsive and sustainable, they help foster a stronger and more resilient Canadian economic and social union.

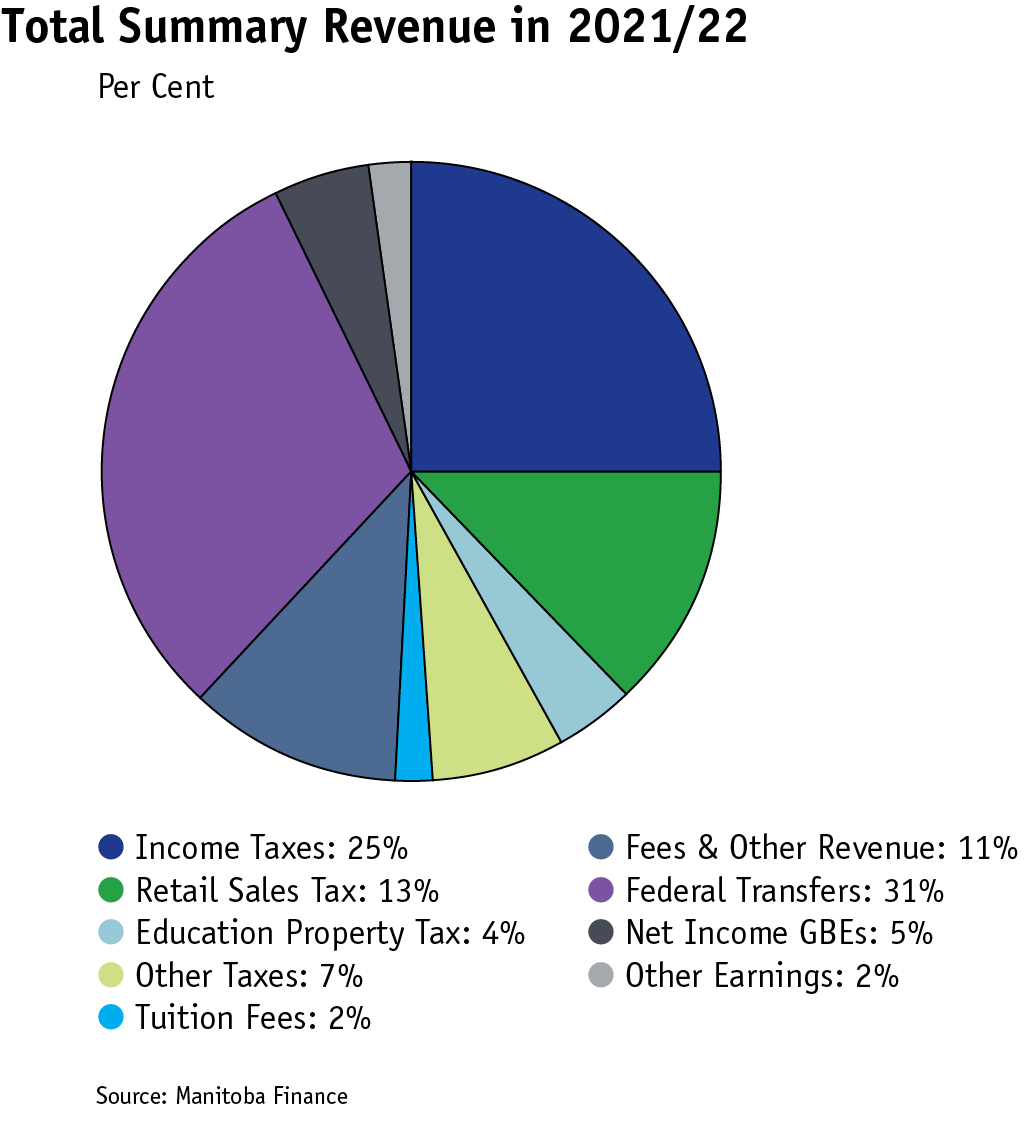

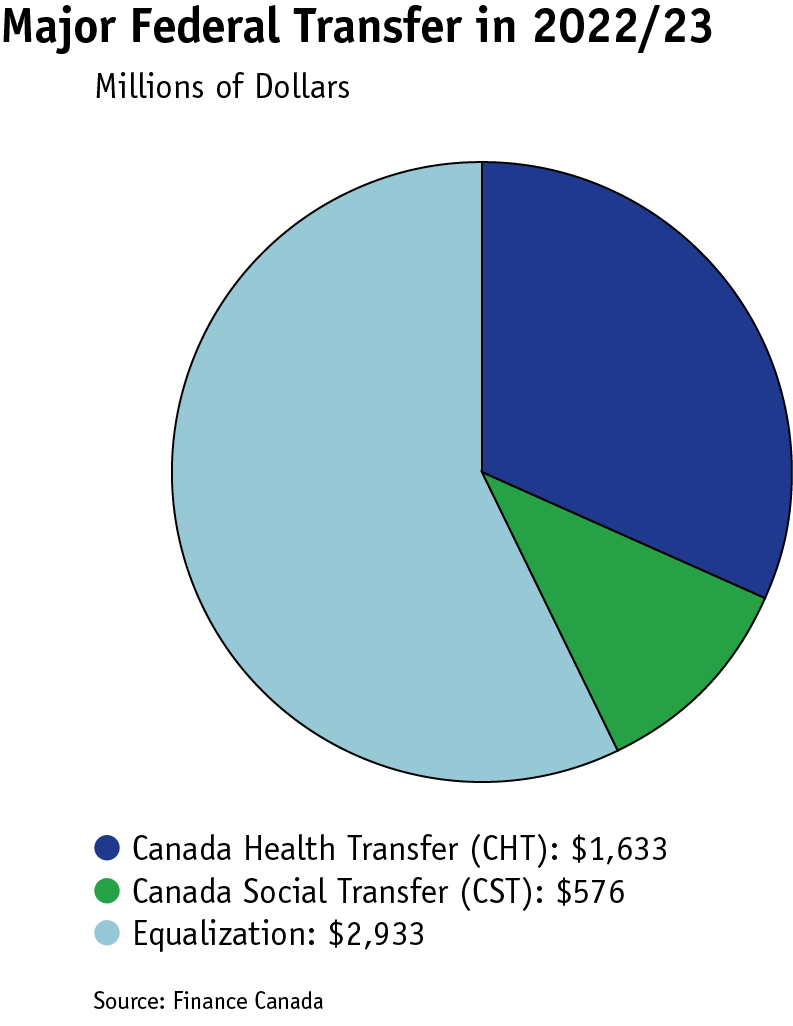

Major federal transfers typically account for about one-quarter of Manitoba’s total summary revenue. Over the past five years, major transfer revenues have grown by $1.2 billion or 29.7 per cent. Manitoba will receive

$5.1 billion through the major transfers in 2022/23, up $301 million or 6.2 per cent over 2021/22. Equalization accounts for 57 per cent of the major federal transfers Manitoba will receive in 2022/23.

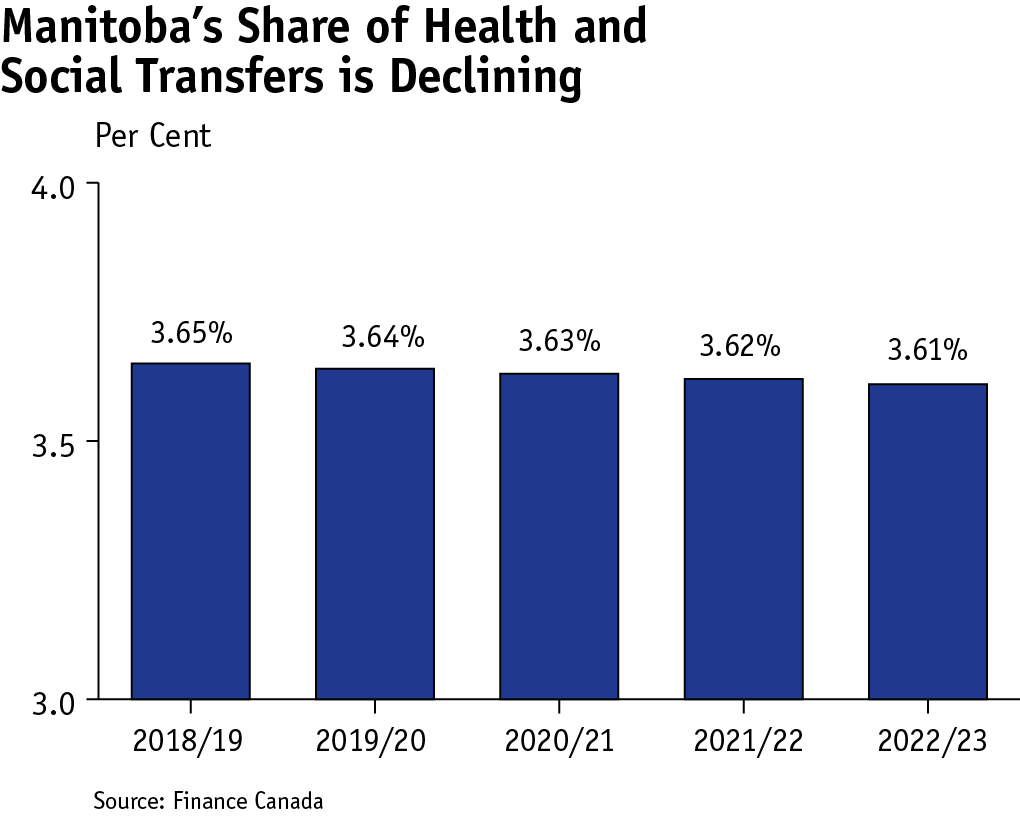

The federal government allocates the major health and social transfers, the CHT and CST, to the provinces and territories on an equal per capita basis. Manitoba’s declining share of the national population of late has resulted in an estimated $23 million less in funding for health and social transfers compared to what would have been the case if the province’s population had grown as fast as the national average.

|

Major Federal Transfers to Manitoba |

|||||

|

(Millions of Dollars) |

2018/19 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

|

Canada Health Transfer (CHT) |

1,410 |

1,471 |

1,520 |

1,562 |

1,633 |

|

Canada Social Transfer (CST) |

518 |

531 |

545 |

560 |

576 |

|

Equalization |

2,037 |

2,255 |

2,510 |

2,719 |

2,933 |

|

Total |

3,965 |

4,257 |

4,575 |

4,841 |

5,142 |

|

Source: Finance Canada |

|||||

Canada Health Transfer

The CHT is the major federal transfer in support of health care. It is also the largest of the major federal transfers. It provides provinces and territories with predictable and unconditional funding allocated on an equal per-capita basis.

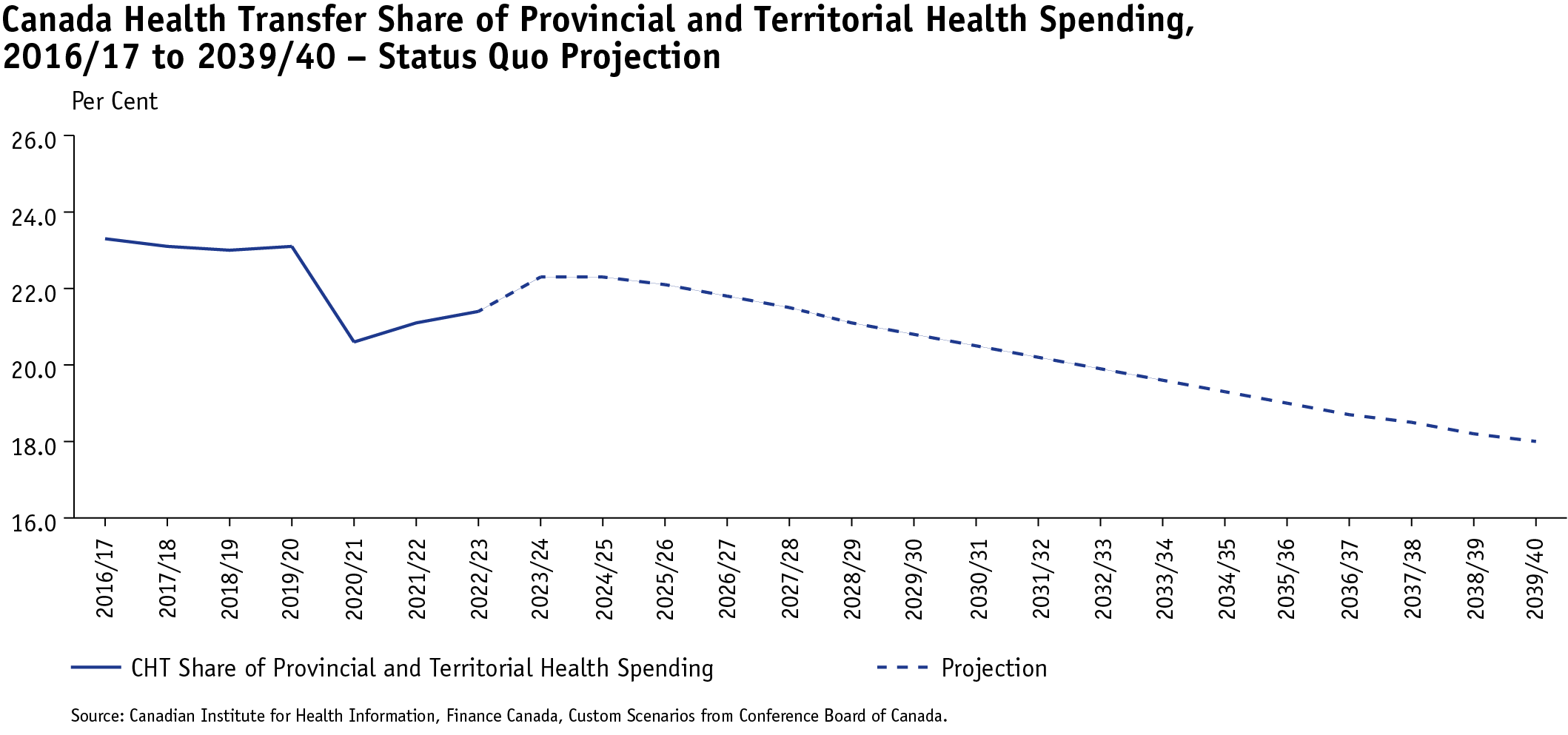

Historically, the federal government has played an important role in helping support provincial and territorial health care services. However, in recent years, provincial and territorial funding for health care has greatly outpaced that of federal contributions.

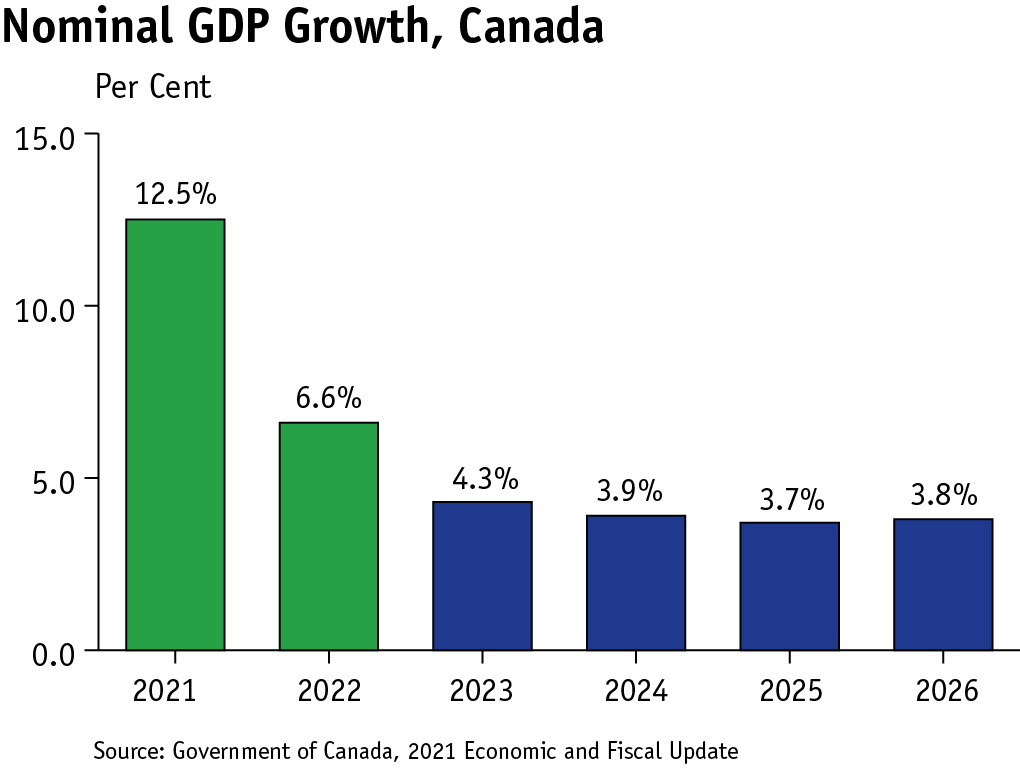

Starting in fiscal year 2017/18, the federal government cut growth in the CHT from a fixed six per cent per year to a three-year moving average of nominal gross domestic product (GDP) growth, with funding guaranteed to increase by three per cent per year.

The decrease in the CHT’s growth rate since 2017/18 has reduced the overall federal contribution through the CHT in supporting total health care costs in Canada, resulting in billions of dollars less in health care funding for provinces and territories. For Manitoba, it means a reduction of $739 million in total when compared to what would have been received during this period under the previous formula.

By 2021, provinces and territories were paying about 78 per cent of total health care costs in Canada, while the federal government paid only about 22 per cent. This funding disparity has placed a growing strain on provincial and territorial health care systems and has directly resulted in health care gaps across Canada.

If the federal government does not increase its support through the CHT and with health costs expected to increase faster than growth in nominal GDP (and growth in the CHT), the federal health care funding share is expected to decline to 20 per cent in 2030 and to 18 per cent by 2039.

The COVID-19 pandemic has only worsened these strains within health care systems. This has resulted in difficult choices for provinces and territories in the delivery of health care services including diverting resources to address COVID-19 related hospitalizations, postponing surgeries, and placing an incredible personal and emotional toll on health care professionals.

Challenges such as the scarcity of ICU beds, doctor and nurse shortages, as well as backlogs for surgeries and diagnostic tests will, in the near future, be further complicated by an increasingly aging population, longer life expectancy, increased demand for mental health and addictions services, and the demand for better longer-term care services. These factors are expected to combine to result in billions in additional health care costs.

While Manitoba appreciates the targeted health funding provided by the federal government, particularly the significant levels of COVID-19 support, it is not a replacement for adequate and predictable support through the major transfers. Unfortunately, the federal government appears to remain focused on time-limited, targeted funding initiatives.

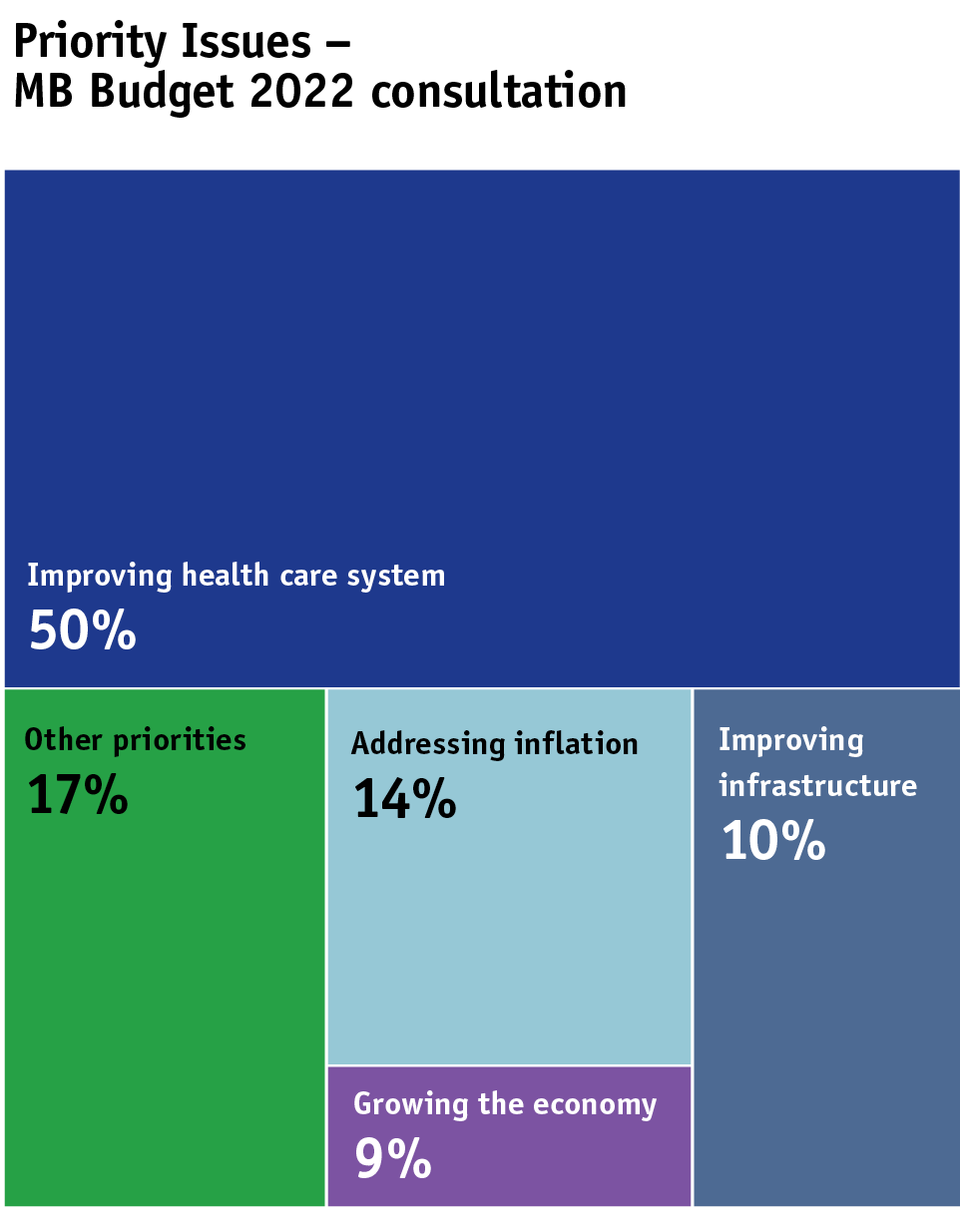

Having access to quality and timely health care services is a top priority for all Canadians. It is also the single largest expenditure item of provincial and territorial governments including Manitoba.

As part of the province’s consultations for Budget 2022, thousands of Manitobans weighed in on which government priority was personally the most important to them. Of all respondents, 86 per cent identified ‘improving the health care system’ as a high priority.

Manitoba will receive a total of $1.6 billion through the CHT in 2022/23, up $71 million or 4.5 per cent from 2021/22. Although higher than last year, this rate of growth is still below projections for the rate at which provincial and territorial health costs will grow in the coming years.

Recent estimates from the Conference Board of Canada (CBOC) suggest provincial and territorial government health expenditures will increase at an average annual rate of about five per cent or higher over the next several years due to population aging and growth, inflation, increased access and system improvements. The lingering effects of COVID-19 are expected to further add to ongoing growth in health expenditures.

According to research prepared by the CBOC, the federal government has the fiscal capacity to increase its support for health care while remaining fiscally sustainable. It concluded that the fiscal pressures currently facing the federal government are, for the most part, temporary, and will improve dramatically once the COVID-19 pandemic is over. In contrast, the fiscal situation facing the provinces and territories is expected to significantly worsen over time, due mostly to increasing health care cost pressures.

After a post COVID-19 downturn rebound in 2021 and 2022, the federal government expects annual nominal GDP growth to be around four per cent or less in the years to come.

Funding provided through the major federal transfers remains the most effective and efficient way the federal government can support provinces and territories in meeting their constitutional spending responsibilities in a fiscally responsible manner.

As well, federal funding through the mostly unconditional 1 major transfers better respects the principle of federalism and the different priorities and preferences of provinces and territories with respect to tax and service levels. That is, the purpose of federal transfers should be to support provinces and territories in providing public services that meet the needs of their residents and not to impose common standards that may not reflect the priorities of the receiving jurisdiction.

Manitoba strongly supports the call by Canada’s premiers for the federal government to increase the CHT’s share of total provincial and territorial health spending to 35 per cent from the current 21 per cent starting in 2021/22, and to maintain this contribution level over time with a minimum annual escalator of five per cent.

All governments share a desire to see health care delivered in a manner that is responsive and sustainable. A renewed and reinvigorated health funding partnership with the federal government through the unconditional CHT will enable provinces and territories to address the needs and challenges that are unique to their respective jurisdictions, and ensure the health care system emerges from the COVID-19 pandemic stronger and more resilient than ever.

Canada Social Transfer

The CST supports post-secondary education, social assistance and social services, as well as early childhood development and early learning and child care. The CST has a fixed, three per cent annual growth rate and is distributed to provinces and territories on an equal per-capita basis. The sole condition for the CST is that there be no minimum residency requirements for people seeking to receive social assistance.

Manitoba will receive $576 million through the CST in 2022/23, up $16 million or 2.9 per cent from 2021/22. Manitoba’s share of the CST nationally is 3.6 per cent.

Equalization

The purpose of the Equalization program was entrenched in the Canadian Constitution in 1982.

Equalization is funded by general taxes paid by all federal taxpayers. The federal government collects revenue from all Canadians and businesses, and redistributes a certain amount to help provinces and territories fund services.

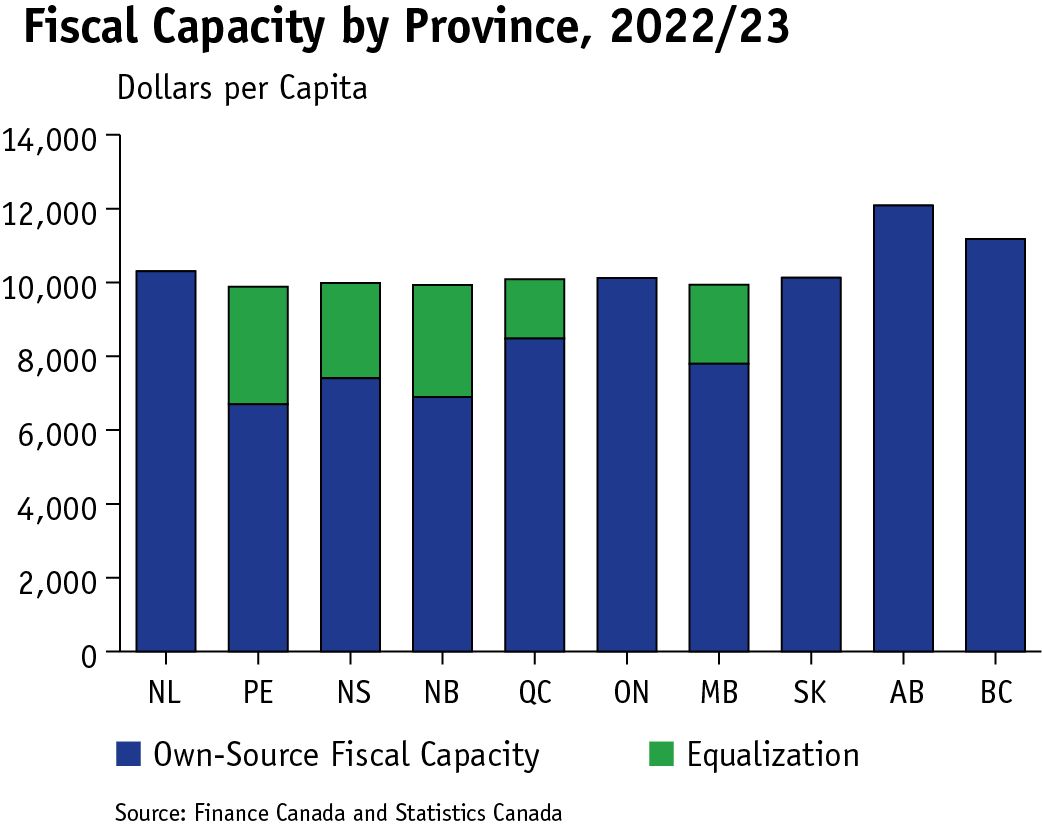

Provinces with per-capita fiscal capacities below the national average receive payments to raise their fiscal capacities to the national average. Provinces above the national average do not receive payments.

Annual growth in the Equalization program is determined by a three-year moving average of growth in Canada’s nominal GDP, while fiscal capacity calculations are based on a three-year, weighted moving average of revenues, with a two-year data lag.

Manitoba will receive $2.9 billion in Equalization funding in 2022/23, up $214 million or 7.9 per cent from 2021/22. Manitoba’s share of the Equalization program nationally is 13.4 per cent.