Summary Budget and Financial Updates

Introduction

The Summary Budget includes an overview of the financial plan for the Manitoba government reporting entity, which includes the services of the government generally associated with the Legislative Assembly

(voted and statutory appropriations and non-voted expenses), government business enterprises (GBEs) (such as Manitoba Hydro and Manitoba Public Insurance), and other reporting entities that are indirectly controlled by the Manitoba government, such as health authorities, post-secondary institutions and school divisions. In the Summary Budget, the voted and statutory appropriations and non-voted expenses are consolidated with the high level projections of other reporting entities and GBEs, according to the standards set by the Public Sector Accounting Board (PSAB). The Summary Budget fully reflects Generally Accepted Accounting Principles (GAAP).

Summary Budget

For the Fiscal Year Ending March 31

|

2022/23

|

2021/22

|

2021/22

|

|

|

(Millions of Dollars) |

|||

|

Revenue |

19,353 |

18,692 |

17,838 |

|

Expenditure |

19,271 |

18,805 |

18,255 |

|

Contingencies and COVID-19 Response and Recovery |

630 |

1,280 |

1,180 |

|

Net Income (Loss) |

(548) |

(1,393) |

(1,597) |

|

Summary Net Debt |

30,544 |

29,272 |

29,998 |

|

Net Debt to GDP |

35.9% |

36.4% |

39.9% |

Notes:

* This report also includes our updated 2021/22 forecast and serves as our third quarter report.

Summary Budget Detail

For the Fiscal Year Ending March 31

|

2022/23 Budget |

2021/22 Forecast* |

2021/22 Budget |

||

|

(Millions of Dollars) |

||||

|

Revenue |

||||

|

Income Taxes |

4,958 |

4,917 |

4,455 |

|

|

Retail Sales Tax |

2,410 |

2,349 |

2,274 |

|

|

Education Property Taxes |

745 |

699 |

693 |

|

|

Other Taxes |

1,501 |

1,349 |

1,313 |

|

|

Tuition Fees |

447 |

422 |

412 |

|

|

Fees and Other Revenue |

2,081 |

2,115 |

1,995 |

|

|

Federal Transfers |

6,250 |

6,095 |

5,640 |

|

|

Net Income of Government Business Enterprises |

834 |

448 |

850 |

|

|

Sinking Funds and Other Earnings |

327 |

298 |

306 |

|

|

Contingency |

(200) |

- |

(100) |

|

|

Total Revenue |

19,353 |

18,692 |

17,838 |

|

|

Expenditure |

||||

|

Legislative Assembly |

53 |

49 |

51 |

|

|

Executive Council |

5 |

5 |

5 |

|

|

Advanced Education, Skills and Immigration |

1,658 |

1,584 |

1,575 |

|

|

Agriculture |

495 |

821 |

367 |

|

|

Economic Development, Investment and Trade |

170 |

194 |

194 |

|

|

Education and Early Childhood Learning |

3,488 |

3,287 |

3,220 |

|

|

Environment, Climate and Parks |

168 |

124 |

164 |

|

|

Families |

2,081 |

2,019 |

2,019 |

|

|

Finance |

69 |

72 |

65 |

|

|

Health |

6,687 |

6,639 |

6,582 |

|

|

Indigenous Reconciliation and Northern Relations |

31 |

31 |

31 |

|

|

Justice |

730 |

699 |

701 |

|

|

Labour, Consumer Protection and Government Services |

420 |

434 |

387 |

|

|

Mental Health and Community Wellness |

399 |

382 |

383 |

|

|

Municipal Relations |

392 |

378 |

378 |

|

|

Natural Resources and Northern Development |

120 |

114 |

113 |

|

|

Public Service Commission |

28 |

27 |

27 |

|

|

Seniors and Long-Term Care |

54 |

- |

- |

|

|

Sport, Culture and Heritage |

91 |

86 |

83 |

|

|

Transportation and Infrastructure |

524 |

498 |

500 |

|

|

Enabling Appropriations |

336 |

235 |

270 |

|

|

Emergency Expenditures |

100 |

100 |

100 |

|

|

Tax Credits** |

147 |

62 |

46 |

|

|

Debt Servicing |

1,025 |

965 |

994 |

|

|

Expenditures excluding Contingencies and COVID-19 Response and Recovery |

19,271 |

18,805 |

18,255 |

|

|

Contingencies and COVID-19 Response and Recovery |

630 |

1,280 |

1,180 |

|

|

Total Expenditures |

19,901 |

20,085 |

19,435 |

|

|

Net Income (Loss) |

(548) |

(1,393) |

(1,597) |

|

Notes:

The 2021/22 forecast and budget has been restated to be consistent with the 2022/23 budget presentation.

* Represents the forecast as of third quarter.

** Tax Credits includes only those tax credits that are recorded as expenditures; other tax credits like the Education Property Tax Credit are recorded

as revenue offsets.

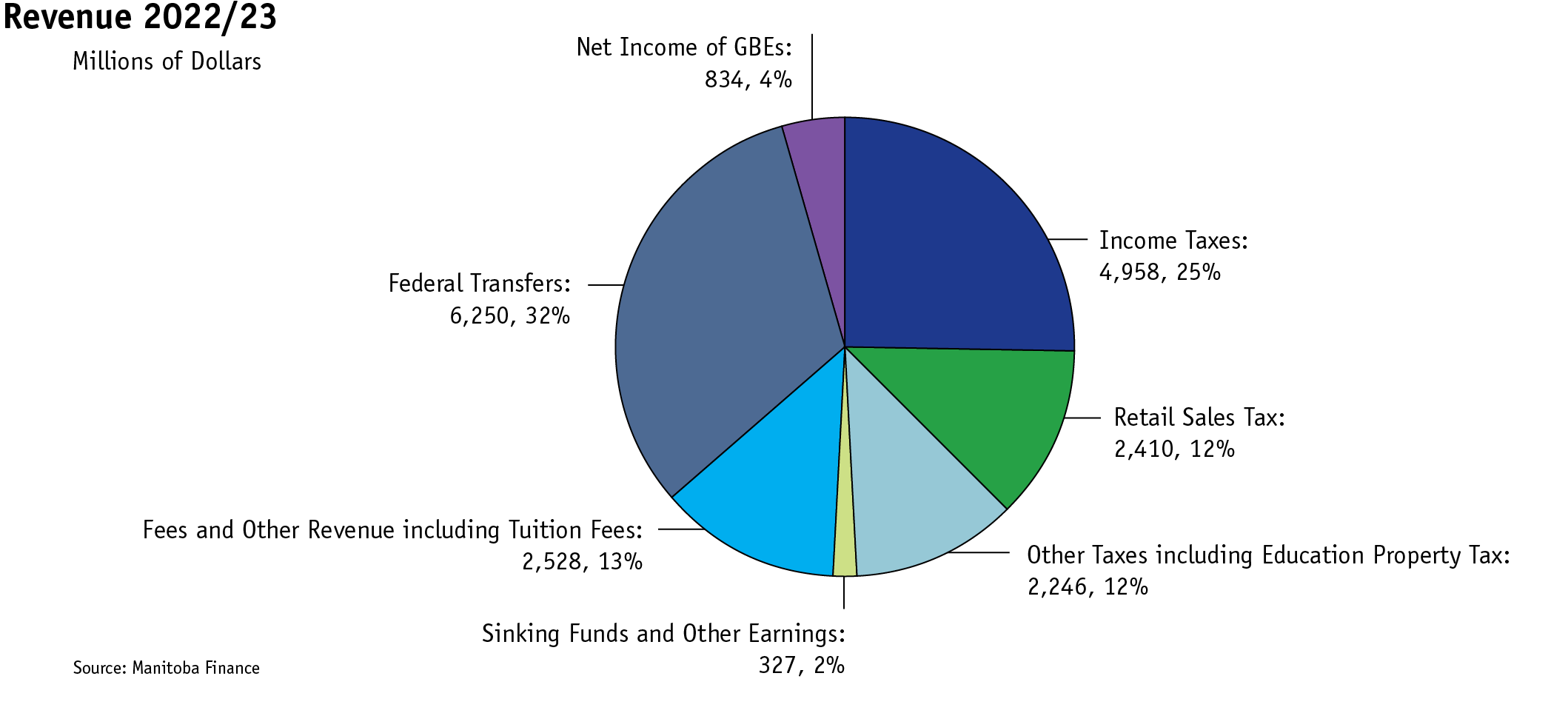

Summary Budget 2022/23

Revenue

Budget 2022 includes a projected revenue increase of $1,515 million or 8.5 per cent from Budget 2021. This growth reflects a positive expansion in GDP, decline in unemployment rates and growth in consumer spending.

Income tax revenue is projected to increase by $503 million from Budget 2021, with a $395 million increase in Individual income tax revenue and a $108 million increase in Corporation income tax revenue. This reflects a continued rebound in labour income and business income.

Retail Sales Tax is projected to increase by $136 million reflecting further reopening of the economy and an increase in household and business spending in 2022.

Education Property Taxes is projected to increase by

$52 million reflecting the change to replace the renters component of the Education Property Tax Credit with a new Renters Tax Credit, offset by increases to the Education Property Tax Rebate in 2022 and 2023.

Other taxes are projected to increase overall by

$188 million from Budget 2021 reflecting a broad based improvement as the economy recovers.

Tuition fees set by Manitoba’s universities and colleges are projected to increase $35 million while fees and other revenue are projected to increase $86 million from Budget 2021.

Federal transfers are projected to increase $610 million, or 10.8 per cent from Budget 2021 reflecting increases in Equalization, other major transfers and bi-lateral agreements.

Net income of Government Business Enterprises is projected to decrease $16 million due to lower projections from Manitoba Hydro-Electric Board driven by the ongoing impact of the drought in 2021, and decline in net revenue by Manitoba Public Insurance

due to declines in basic premium rates and expected growth in claims post pandemic. These lower projections are offset by increases in revenues from Manitoba Liquor and Lotteries Corporation with the re-opening of casinos and VLT network.

Sinking funds and other earnings are projected to slightly increase by $21 million from Budget 2021.

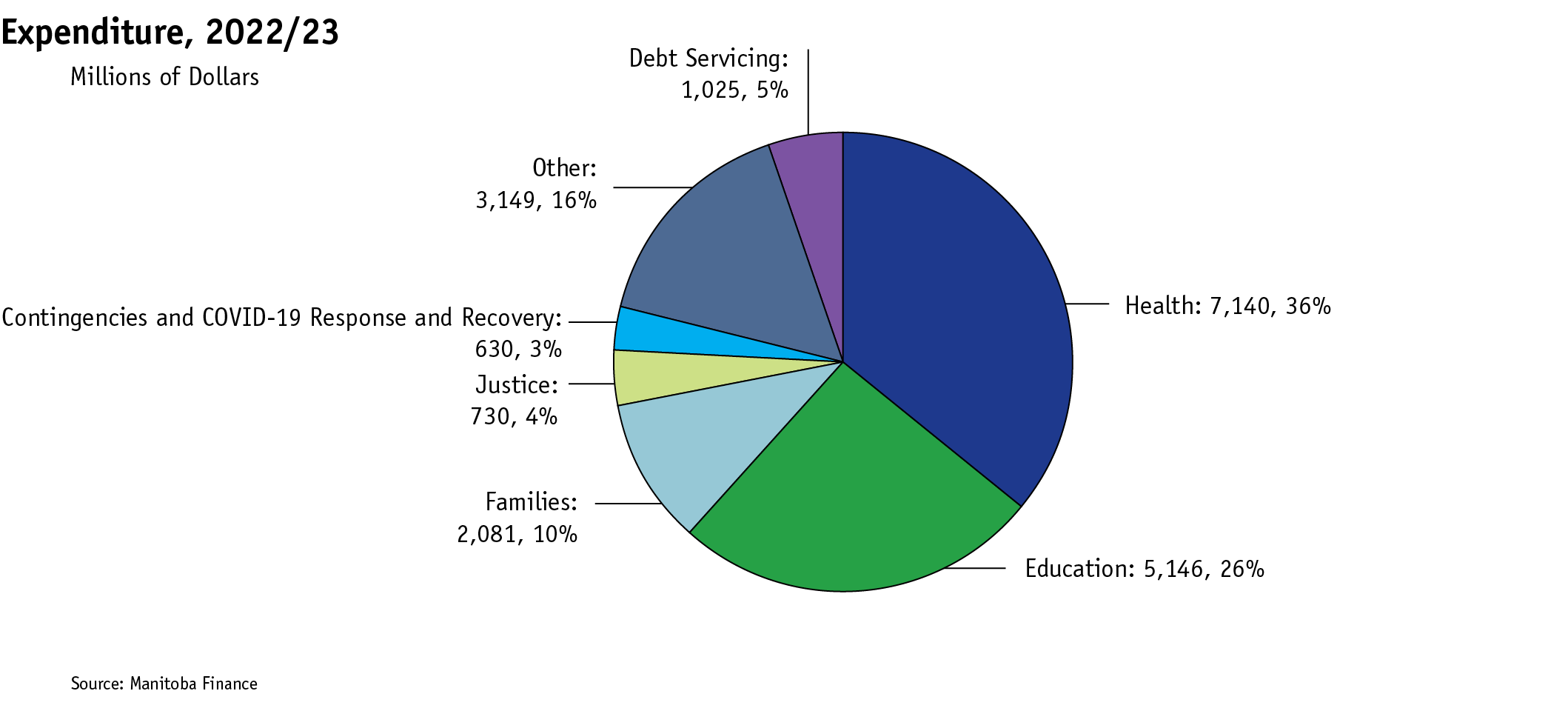

Expenditure

Expenditures in 2022/23 are projected to increase $466 million overall, or 2.4 per cent from Budget 2021. Expenditures before Contingencies and COVID-19 Response and Recovery are projected to increase $1,016 million while Contingencies and COVID-19 Response and Recovery is decreasing by $550 million from $1,180 million in Budget 2021 to $630 million in Budget 2022.

Significant changes in departmental expenditures include a $105 million or 1.6 per cent increase in Health reflecting on-going requirements as part of the wage settlement reached with Manitoba Nurses Union and other increases in medical remuneration, Pharmacare and provincial

health services.

Education and Early Childhood Learning has projected an increase of $268 million largely due to the Canada-Wide Early Learning and Child Care Agreement that is fully offset by federal transfers and cost increases in the school divisions.

Families has projected an increase of $62 million as a result of volume increases to the Community Living disABILITY Services and Employment, Income and Rental Assistance programs.

Agriculture’s expenditures have increased by $128 million due to a change in the accounting treatment of Agri-insurance indemnities. The increase in expenses are offset by increases in fees and other revenues and federal transfers.

Advanced Education, Skills and Immigration has projected an increase of $83 million mainly due to higher personnel and operating expenses at post-secondary institutions.

The new department of Seniors and Long-Term Care includes an increase of $54 million for initiatives

stemming from the Stevenson Review Recommendations and funding related to the new Seniors Strategy.

Enabling Appropriations is projected to increase by

$66 million largely due to an increase in funding to address the surgical and diagnostic backlog and the creation of the new Community Arts, Culture and Sports Fund. These increases are partially offset by reductions in other areas.

Tax Credits has projected an increase of $101 million largely due to the new Renters Tax Credit and a moderate increase to the Film and Video Production Tax Credit.

Debt Servicing is projected to increase by $31 million due to higher interest rates.

2021/22 Forecast

Revenue

Overall, revenue is forecast at $854 million higher compared to budget for 2021/22. $399 million of the increase is due to own source revenue and net income from government business enterprises and $455 million is from an increase in federal transfers.

Individual income tax revenue is $339 million higher than budget, while Corporation income tax revenue is

$123 million higher than budget reflecting a total increase of $462 million based on higher than forecast

economic growth.

Retail Sales Tax and other taxes are forecast to be $75 million and $42 million over budget respectively. These increases reflect increased consumer spending, a stronger housing market, recovery of lost employment in several sectors and higher than forecast payroll tax remittances as economic recovery from the impact of COVID-19 continues.

Tuition fees are forecast at $10 million over budget while fees and other revenue are forecast at $120 million over budget.

Federal transfers are $455 million over budget mainly due to additional federal contributions to support Manitoba’s COVID-19 response and transfers related to the Canada-Wide Early Learning and Child Care Strategy and the Agri-Recovery Drought Assistance Program, partially offset by a delay in federal transfers related to the Investing in Canada Infrastructure Program (ICIP).

Net income of Government Business Enterprises is forecast at $402 million lower than budget. The decrease is driven by projected losses by Manitoba Hydro-Electric Board which was negatively impacted by the drought conditions in the summer.

Expenditure

Expenditures in 2021/22 are forecast at $650 million over budget, which includes $100 million in additional expenditures on COVID-19 relief programs obtained through supplementary appropriations.

Agriculture is forecasting an increase of $454 million due to higher claim payouts as a result of the 2021 drought partially offset by an increase in revenue.

Education and Early Childhood Learning is forecasting a variance of $67 million over budget largely due to the Canada-Wide Early Learning and Child Care Agreement, which is fully offset by federal transfers.

Environment, Climate and Parks is forecasting an under-expenditure of $40 million primarily in Efficiency Manitoba, due to lower customer incentive payments, supplies and services due to supply chain issues driven by the pandemic.

Health is forecasting a variance of $57 million over budget due to price and volume pressures required to provide essential health services to Manitobans.

Labour, Consumer Protection and Government Services is forecasting an over expenditure of $47 million, primarily due to pandemic related supplies that have been donated by the federal government offset by an under-expenditure due to the timing of federal transfers through the Investing in Canada Infrastructure Program (ICIP) being delivered by municipalities. As a result, the federal transfers have been delayed to 2022/23 resulting in a lapse in the provincial expenditures used to flow the federal funds.

Enabling Appropriations is forecasting a decrease of $35 million as the planned devolution of the Manitoba Centennial Centre Corporation is not proceeding at

this time.

Tax Credits is forecasting an increase of $16 million over budget, mainly related to 2020 tax year assessments for the Film and Video Production Tax Credit.

Debt Servicing is forecasting to be $29 million under budget reflecting lingering lower interest rates during this period.

Summary Revenue

For the Fiscal Year Ending March 31

|

2022/23 Budget |

2021/22 Forecast* |

2021/22 Budget |

|||

|

(Millions of Dollars) |

|||||

|

Income Taxes |

|||||

|

Individual Income Tax |

4,314 |

4,258 |

3,919 |

||

|

Corporation Income Tax |

644 |

659 |

536 |

||

|

Subtotal: Income Taxes |

4,958 |

4,917 |

4,455 |

||

|

Retail Sales Tax |

2,410 |

2,349 |

2,274 |

||

|

Education Property Taxes |

745 |

699 |

693 |

||

|

Other Taxes |

|||||

|

Corporations Taxes |

366 |

322 |

322 |

||

|

Fuel Taxes |

359 |

314 |

314 |

||

|

Land Transfer Tax |

149 |

150 |

96 |

||

|

Levy for Health and Education |

422 |

373 |

371 |

||

|

Tobacco Tax |

192 |

178 |

198 |

||

|

Other Taxes |

13 |

12 |

12 |

||

|

Subtotal: Other Taxes |

1,501 |

1,349 |

1,313 |

||

|

Tuition Fees |

447 |

422 |

412 |

||

|

Fees and Other Revenue |

|||||

|

Fines and Costs and Other Legal |

49 |

49 |

49 |

||

|

Minerals and Petroleum |

17 |

18 |

14 |

||

|

Automobile and Motor Carrier Licences and Fees |

166 |

171 |

178 |

||

|

Parks: Forestry and Other Conservation |

29 |

32 |

28 |

||

|

Water Power Rentals |

120 |

89 |

131 |

||

|

Service Fees and Other Miscellaneous Charges |

1,700 |

1,756 |

1,595 |

||

|

Subtotal: Fees and Other Revenue |

2,081 |

2,115 |

1,995 |

||

|

Federal Transfers |

|||||

|

Equalization |

2,933 |

2,719 |

2,719 |

||

|

Canada Health Transfer (CHT) |

1,633 |

1,561 |

1,560 |

||

|

Canada Social Transfer (CST) |

576 |

560 |

560 |

||

|

COVID-19 Transfers |

- |

211 |

- |

||

|

Shared Cost and Other Transfers |

1,108 |

1,044 |

801 |

||

|

Subtotal: Federal Transfers |

6,250 |

6,095 |

5,640 |

||

|

Net Income of Government Business Enterprises (GBEs) |

|||||

|

Manitoba Liquor and Lotteries Corporation |

635 |

570 |

570 |

||

|

Deposit Guarantee Corporation of Manitoba |

31 |

29 |

29 |

||

|

Manitoba Hydro-Electric Board |

120 |

(221) |

190 |

||

|

Manitoba Public Insurance Corporation |

48 |

70 |

61 |

||

|

Subtotal: Net Income of GBEs |

834 |

448 |

850 |

||

|

Sinking Funds and Other Earnings |

327 |

298 |

306 |

||

|

Contingency |

(200) |

- |

(100) |

||

|

Total Revenue |

19,353 |

18,692 |

17,838 |

||

* Represents the forecast as of third quarter.

Summary Expenditure

For the Fiscal Year Ending March 31

|

2022/23 Budget |

2021/22 Forecast* |

2021/22 Budget |

|

|

(Millions of Dollars) |

|||

|

Expenditure (excluding Contingencies and COVID-19 Response and Recovery) |

|||

|

Legislative Assembly |

53 |

49 |

51 |

|

Executive Council |

5 |

5 |

5 |

|

Advanced Education, Skills and Immigration |

1,658 |

1,584 |

1,575 |

|

Agriculture |

495 |

821 |

367 |

|

Economic Development, Investment and Trade |

170 |

194 |

194 |

|

Education and Early Childhood Learning |

3,488 |

3,287 |

3,220 |

|

Environment, Climate and Parks |

168 |

124 |

164 |

|

Families |

2,081 |

2,019 |

2,019 |

|

Finance |

69 |

72 |

65 |

|

Health |

6,687 |

6,639 |

6,582 |

|

Indigenous Reconciliation and Northern Relations |

31 |

31 |

31 |

|

Justice |

730 |

699 |

701 |

|

Labour, Consumer Protection and Government Services |

420 |

434 |

387 |

|

Mental Health and Community Wellness |

399 |

382 |

383 |

|

Municipal Relations |

392 |

378 |

378 |

|

Natural Resources and Northern Development |

120 |

114 |

113 |

|

Public Service Commission |

28 |

27 |

27 |

|

Seniors and Long-Term Care |

54 |

- |

- |

|

Sport, Culture and Heritage |

91 |

86 |

83 |

|

Transportation and Infrastructure |

524 |

498 |

500 |

|

Enabling Appropriations |

336 |

235 |

270 |

|

Emergency Expenditures |

100 |

100 |

100 |

|

Tax Credits** |

147 |

62 |

46 |

|

Debt Servicing |

1,025 |

965 |

994 |

|

Subtotal |

19,271 |

18,805 |

18,255 |

|

Contingencies and COVID-19 Response and Recovery |

|||

|

Economic Development, Investment and Trade |

- |

105 |

- |

|

Education and Early Childhood Learning |

- |

114 |

- |

|

Families |

- |

11 |

- |

|

Finance |

- |

113 |

- |

|

Health |

- |

366 |

- |

|

Indigenous Reconciliation and Northern Relations |

- |

6 |

- |

|

Justice |

- |

14 |

- |

|

Labour, Consumer Protection and Government Services |

- |

270 |

- |

|

Mental Health and Community Wellness |

- |

2 |

- |

|

Municipal Relations |

- |

43 |

- |

|

Public Service Commission |

- |

9 |

- |

|

Sport, Culture and Heritage |

- |

6 |

- |

|

Enabling Appropriations |

630 |

221 |

1,180 |

|

Subtotal |

630 |

1,280 |

1,180 |

|

Total Expenditures |

19,901 |

20,085 |

19,435 |

Notes:

* Represents the forecast as of third quarter.

** Tax Credits includes only those tax credits that are recorded as expenditures;

other tax credits like the Education Property Tax Credit are recorded as revenue offsets.

Total Revenue: $19,553

Note: a revenue contingency of $200 million used for fiscal planning further reduces the projection to $19,353.

Total Expenditure: $19,901

Financial Updates

Summary Net Debt

Summary Net Debt is an important indicator of a government’s financial position, as this highlights the affordability of future government services. Summary net debt represents the difference between the Government Reporting Entity’s total liabilities, less financial assets; it reflects the residual liability that must be financed by future revenues. It is important to measure changes in net debt against the growth of the economy, as measured by nominal GDP.

In Budget 2022, the net debt to GDP ratio is forecast to be 35.9 per cent. This is a decrease from 39.9 per cen t in Budget 2021.

|

2022/23 Budget |

2021/22 Forecast |

|

|

(Millions of Dollars) |

||

|

Summary Net Debt, beginning of year |

29,272 |

27,424 |

|

Net Investment in Tangible Capital Assets |

724 |

455 |

|

Plus: Projected (Income) Loss for the Year |

548 |

1,393 |

|

Change in Net Debt |

1,272 |

1,848 |

|

Summary Net Debt, end of year |

30,544 |

29,272 |

Capital Investment

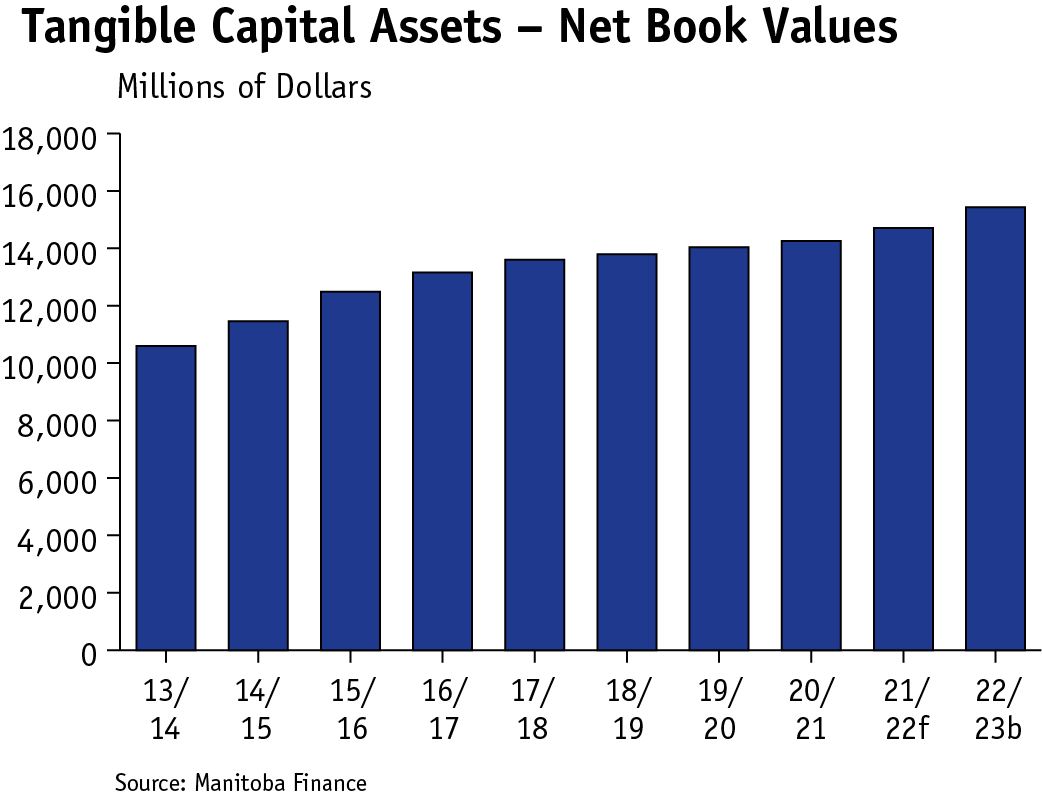

Capital investment continues to be a priority across government. An investment made to construct or enhance capital assets is a benefit to Manitobans for the provision of services needed into the future. Tangible capital assets are assets with a useful life extending beyond one year, which are acquired, constructed or developed and held for use, not for resale. Net investment in tangible capital assets is projected to be $15.4 billion as at March 31, 2023.

Tangible Capital Assets – Net Book ValuesProjection as at March 31 |

||

|

2022/23 Budget |

2021/22 Forecast |

|

|

(Millions of Dollars) |

||

|

Cost of Assets, beginning of year |

26,893 |

25,625 |

|

Additions |

1,573 |

1,268 |

|

Cost of Assets, end of year |

28,466 |

26,893 |

|

Accumulated Amortization, beginning of year |

12,183 |

11,370 |

|

Amortization |

849 |

813 |

|

Accumulated Amortization, end of year |

13,032 |

12,183 |

|

Net Book Value |

15,434 |

14,710 |

Borrowing Requirements

Manitoba’s borrowing requirements with respect to both general and self-sustaining borrowings are estimated to total $4.7 billion in 2022/23, of which $3.2 billion is required for refinancing purposes. New cash requirements, net of estimated repayments, are $1.5 billion, which includes requirements for general government purposes, capital investments by departments and the Manitoba Hydro-Electric Board. To date, approximately $1.5 billion of funding for 2022/23 has been pre-borrowed.

Manitoba will also pre-fund approximately $1.6 billion of borrowing requirements for fiscal 2023/24. This will reduce the amount that needs to be borrowed next fiscal year.

|

Borrowing Requirements 2022/23 |

|||||||

|

Refinancing |

New Cash Requirements |

Estimated Repayments |

Gross Borrowing Repayments |

Pre-Borrowed

|

Pre-Funding March 31, 2023 |

Borrowing Requirements |

|

|

(Millions of Dollars) |

|||||||

|

Government Business Enterprises |

|||||||

|

Manitoba Hydro-Electric Board |

1,151 |

300 |

- |

1,451 |

- |

- |

1,451 |

|

Manitoba Liquor and Lotteries Corporation |

75 |

70 |

55 |

90 |

- |

- |

90 |

|

Subtotal |

1,226 |

370 |

55 |

1,541 |

- |

- |

1,541 |

|

Other Borrowings |

|||||||

|

General Purpose Borrowings |

893 |

366 |

- |

1,259 |

1,152 |

721 |

828 |

|

Capital Investment Assets |

531 |

949 |

344 |

1,136 |

357 |

425 |

1,204 |

|

Health Facilities |

- |

200 |

125 |

75 |

- |

196 |

271 |

|

Other Crowns and Organizations |

75 |

509 |

276 |

308 |

- |

302 |

610 |

|

Public School Divisions |

- |

260 |

39 |

221 |

- |

- |

221 |

|

Subtotal |

1,499 |

2,284 |

784 |

2,999 |

1,509 |

1,644 |

3,134 |

|

Total Borrowing Requirements |

2,725 |

2,654 |

839 |

4,540 |

1,509 |

1,644 |

4,675 |

Special Accounts

Pension Assets Fund

The trust conditions of the funds held in the Pension Asset Fund are irrevocably restricted for pension purposes only. Net investment earnings of pension assets include the expected rate of return during the year, as well as adjustments to the market-related value. Market fluctuations of pension assets are not recorded in the year in which they occur, but are recognized over the employee average remaining service life.

The fund is expected to have a balance of $5,234 million by the end of the 2022/23 fiscal year.

|

Pension Assets Fund Projection as at March 31 |

|||

|

2022/23 Budget |

2021/22 Forecast |

||

|

(Millions of Dollars) |

|||

|

Balance, beginning of year |

5,177 |

5,108 |

|

|

Contributions and Revenue |

|||

|

Net Investment Earnings |

335 |

336 |

|

|

Departments and Crown Corporations |

231 |

232 |

|

|

566 |

568 |

||

|

Transfers |

|||

|

Teachers&apos Retirement Allowances Fund and Civil Service Superannuation Fund payments |

(509) |

(499) |

|

|

Balance, end of year |

5,234 |

5,177 |

|

Fiscal Stabilization Account

The Fiscal Stabilization Account, also known as the rainy day fund, is expected to have a balance of $585 million as at March 31, 2022. Any draws or deposits for 2022/23 will be announced closer to year end.

Manitoba Summary Financial Statistics

|

2022/23 Budget |

2021/22 Forecast |

2020/21 Actual |

2019/20 Actual |

2018/19

|

2017/18

|

|||

|

SUMMARY FINANCIAL STATEMENTS |

(Millions of Dollars) |

|||||||

|

Revenue |

||||||||

|

Income Taxes |

4,958 |

4,917 |

4,199 |

4,515 |

4,234 |

3,985 |

||

|

Other Taxes |

4,656 |

4,397 |

4,429 |

4,492 |

4,685 |

4,588 |

||

|

Fees and Other Revenue |

2,528 |

2,537 |

2,332 |

2,465 |

2,341 |

2,364 |

||

|

Federal Transfers |

6,250 |

6,095 |

5,936 |

4,879 |

4,531 |

4,200 |

||

|

Net Income of Government Business Enterprises |

834 |

448 |

600 |

913 |

919 |

758 |

||

|

Sinking Funds and Other Earnings |

327 |

298 |

323 |

377 |

318 |

257 |

||

|

Contingency |

(200) |

- |

- |

- |

- |

- |

||

|

Total Revenue |

19,353 |

18,692 |

17,819 |

17,641 |

17,028 |

16,152 |

||

|

Expenditures (excluding Debt Servicing) |

18,876 |

19,120 |

18,967 |

16,599 |

16,177 |

15,894 |

||

|

Debt Servicing |

1,025 |

965 |

969 |

1,037 |

1,000 |

952 |

||

|

Expenditure |

19,901 |

20,085 |

19,936 |

17,636 |

17,177 |

16,846 |

||

|

Net Income (Loss) |

(548) |

(1,393) |

(2,117) |

5 |

(149) |

(694) |

||

|

Tangible Capital assets |

||||||||

|

Acquisition of tangible capital assets |

(1,573) |

(1,268) |

(1,061) |

(1,025) |

(1,006) |

(1,123) |

||

|

Amortization of tangible capital assets |

849 |

813 |

783 |

745 |

723 |

713 |

||

|

Disposal of tangible capital assets |

- |

- |

64 |

93 |

39 |

48 |

||

|

Subtotal |

(724) |

(455) |

(214) |

(187) |

(244) |

(362) |

||

|

Other Non-Financial Assets |

||||||||

|

Decrease (Increase) in inventories |

- |

- |

(111) |

(8) |

3 |

3 |

||

|

Decrease (Increase) in prepaid expenses |

- |

- |

(5) |

(4) |

(10) |

(2) |

||

|

Subtotal |

- |

- |

(116) |

(12) |

(7) |

1 |

||

|

Other comprehensive income (loss) |

- |

- |

243 |

69 |

(225) |

(14) |

||

|

(Increase) in Net Debt |

(1,272) |

(1,848) |

(2,204) |

(125) |

(625) |

(1,069) |

||

|

Summary Net Debt, beginning of year |

(29,272) |

(27,424) |

(25,220) |

(25,095) |

(24,470) |

(23,276) |

||

|

Change in Accounting Policy |

- |

- |

- |

- |

- |

(125) |

||

|

Summary Net Debt |

(30,544) |

(29,272) |

(27,424) |

(25,220) |

(25,095) |

(24,470) |

||

|

Note: Numbers may not add due to rounding. |

||||||||

Manitoba Summary Financial Statistics

|

2022/23 Budget |

2021/22 Forecast |

2020/21 Actual |

2019/20 Actual |

2018/19 Actual |

2017/18 Actual |

||

|

Annual Change |

(Percentage Change) |

||||||

|

Income Taxes |

0.8 |

17.1 |

(7.0) |

6.6 |

6.2 |

0.7 |

|

|

Other Taxes |

5.9 |

(0.7) |

(1.4) |

(4.1) |

2.1 |

4.4 |

|

|

Fees and Other Revenue |

(0.4) |

8.8 |

(5.4) |

5.3 |

(1.0) |

1.5 |

|

|

Federal Transfers |

2.5 |

2.7 |

21.7 |

7.7 |

7.9 |

1.7 |

|

|

Total Revenue |

3.5 |

4.9 |

1.0 |

3.6 |

5.4 |

3.4 |

|

|

Debt Servicing |

6.2 |

(0.4) |

(6.6) |

3.7 |

5.0 |

2.4 |

|

|

Total Expenditure |

(0.9) |

0.7 |

13.0 |

2.7 |

2.0 |

2.6 |

|

|

Summary Net Debt |

4.3 |

6.7 |

8.7 |

0.5 |

2.6 |

5.1 |

|

|

Per Cent of GDP |

(Per Cent) |

||||||

|

Income Taxes |

5.8 |

6.1 |

5.8 |

6.1 |

5.8 |

5.6 |

|

|

Other Taxes |

5.5 |

5.5 |

6.1 |

6.1 |

6.4 |

6.4 |

|

|

Fees and Other Revenue |

3.0 |

3.2 |

3.2 |

3.3 |

3.2 |

3.3 |

|

|

Federal Transfers |

7.3 |

7.6 |

8.1 |

6.6 |

6.2 |

5.9 |

|

|

Total Revenue |

22.7 |

23.2 |

24.5 |

23.9 |

23.2 |

22.7 |

|

|

Debt Servicing |

1.2 |

1.2 |

1.3 |

1.4 |

1.4 |

1.3 |

|

|

Total Expenditure |

23.4 |

25.0 |

27.4 |

23.9 |

23.4 |

23.6 |

|

|

Summary Net Debt |

(35.9) |

(36.4) |

(37.6) |

(34.1) |

(34.2) |

(34.3) |

|

|

Per Cent of Revenue |

|||||||

|

Income Taxes |

25.6 |

26.3 |

23.6 |

25.6 |

24.9 |

24.7 |

|

|

Other Taxes |

24.1 |

23.5 |

24.9 |

25.5 |

27.5 |

28.4 |

|

|

Fees and Other Revenue |

13.1 |

13.6 |

13.1 |

14.0 |

13.7 |

14.6 |

|

|

Federal Transfers |

32.3 |

32.6 |

33.3 |

27.7 |

26.6 |

26.0 |

|

|

Net Income of Government Business Enterprises |

4.3 |

2.4 |

3.4 |

5.2 |

5.4 |

4.7 |

|

|

Sinking Funds and Other Earnings |

1.7 |

1.6 |

1.8 |

2.1 |

1.9 |

1.6 |

|

|

Debt Servicing |

5.3 |

5.2 |

5.4 |

5.9 |

5.9 |

5.9 |

|

|

Dollars Per Capita |

(Dollars) |

||||||

|

Total Revenue |

13,885 |

13,508 |

12,907 |

12,877 |

12,587 |

12,101 |

|

|

Total Expenditure |

14,278 |

14,514 |

14,440 |

12,873 |

12,697 |

12,621 |

|

|

Debt Servicing |

735 |

697 |

702 |

757 |

739 |

713 |

|

|

Summary Net Debt |

(21,914) |

(21,153) |

(19,864) |

(18,409) |

(18,550) |

(18,332) |

|

|

Memorandum Items |

|||||||

|

Population (000s)* |

1,393.8 |

1,383.8 |

1,380.6 |

1,370.0 |

1,352.8 |

1,334.8 |

|

|

GDP at Market Prices |

85,115 |

80,449 |

72,850 |

73,899 |

73,373 |

71,284 |

|

|

Source: Manitoba Finance * official population July 1 Note: Numbers may not add due to rounding. |

|||||||

Entities Included in

the Summary Budget

Legislative Assembly

Executive Council

Advanced Education, Skills and Immigration

Assiniboine Community College

Brandon University

Manitoba Institute of Trades and Technology

Red River College Polytechnic

Université de Saint-Boniface

University College of the North

University of Manitoba

University of Winnipeg

Agriculture

Manitoba Agricultural Services Corporation

Economic Development, Investment and Trade

Communities Economic Development Fund

Economic Development Winnipeg Inc.*

Manitoba Development Corporation

Manitoba Opportunities Fund Ltd.

Research Manitoba

Rural Manitoba Economic Development Corporation

Education and Early Childhood Learning

Public School Divisions

Environment, Climate and Parks

Efficiency Manitoba Inc.

Manitoba Hazardous Waste Management Corporation

Families

General Child and Family Services Authority

Manitoba Housing and Renewal Corporation

Finance

Insurance Council of Manitoba

Manitoba Financial Services Agency

Special Operating Agencies Financing Authority

Pension Assets Fund

Health

CancerCare Manitoba

Not-for-Profit Personal Care Homes and Community Health Agencies

Regional Health Authorities (including controlled organizations)

Interlake-Eastern Regional Health Authority

Northern Regional Health Authority

Prairie Mountain Health

Southern Health-Santé Sud

Winnipeg Regional Health Authority

Rehabilitation Centre for Children, Inc.

Shared Health Inc.

St. Amant Inc.

Indigenous Reconciliation and Northern Relations

Justice

Legal Aid Manitoba

Liquor, Gaming and Cannabis Authority of Manitoba

Manitoba Law Reform Commission

Labour, Consumer Protection and Government Services

Entrepreneurship Manitoba

Manitoba Education, Research and Learning Information Networks (MERLIN)

Materials Distribution Agency

The Public Guardian and Trustee of Manitoba

Vehicle and Equipment Management Agency

Mental Health and Community Wellness

Addictions Foundation of Manitoba

Municipal Relations

Manitoba Water Services Board

North Portage Development Corporation**

Natural Resources and Northern Development

Abandonment Reserve Fund

Manitoba Liquor and Lotteries Corporation

Manitoba Potash Corporation

Mining Rehabilitation Reserve Fund

Quarry Rehabilitation Reserve Fund

Public Service Commission

Seniors and Long-Term Care

Sport, Culture and Heritage

Le Centre culturel franco-manitobain

Manitoba Arts Council

Manitoba Centennial Centre Corporation

Manitoba Combative Sports Commission

Manitoba Film and Sound Recording Development Corporation

Sport Manitoba Inc.

Travel Manitoba

Transportation and Infrastructure

Government Business Enterprises

Deposit Guarantee Corporation of Manitoba

Manitoba Hydro-Electric Board

Manitoba Liquor and Lotteries Corporation

Manitoba Public Insurance Corporation

Special Accounts, not attached to a Department

Fiscal Stabilization Account (Rainy Day Fund)

Entities to cease being separate reporting entities in 2022/23

Industrial Technology Centre

Manitoba Horse Racing Commission

Notes:

* Economic Development Winnipeg Inc. is a government partnership

** North Portage Development Corporation is a government business partnership