|

Education Property Tax

Education Property Tax Rebate Continues in 2022

Manitoba is continuing to phase out education property taxes by implementing the Education Property Tax Rebate.

Property owners will receive an Education Property Tax Rebate cheque to offset a portion of their education property taxes, enabling them to keep more of their hard earned money. No application is required.

How the rebate works

Residential and farm properties

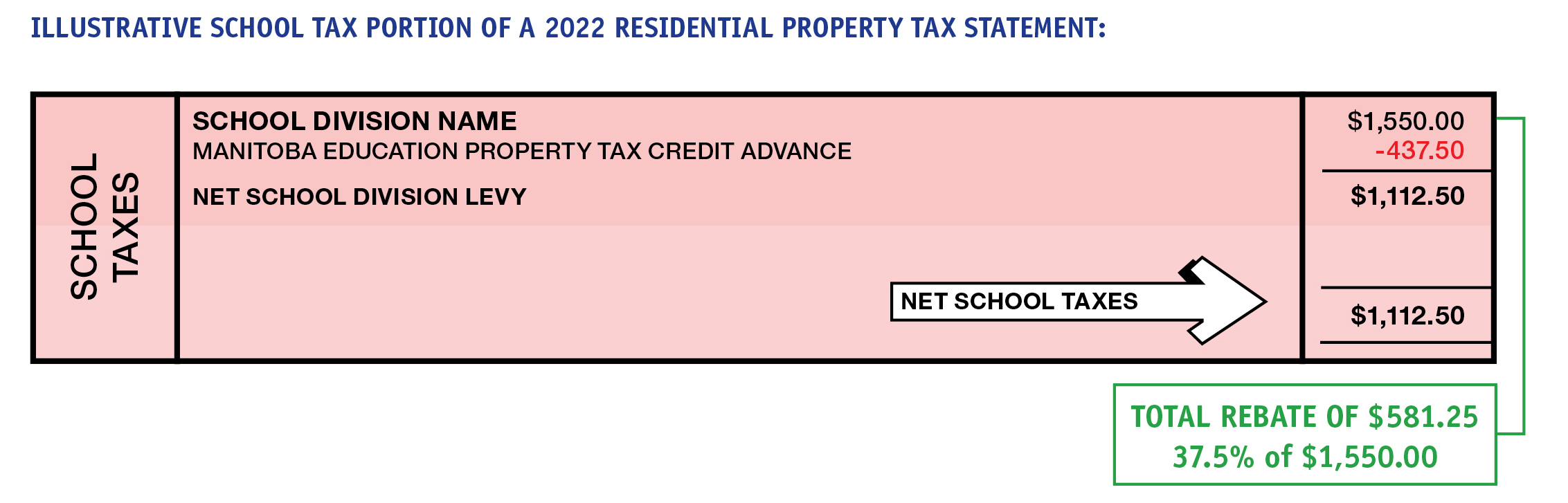

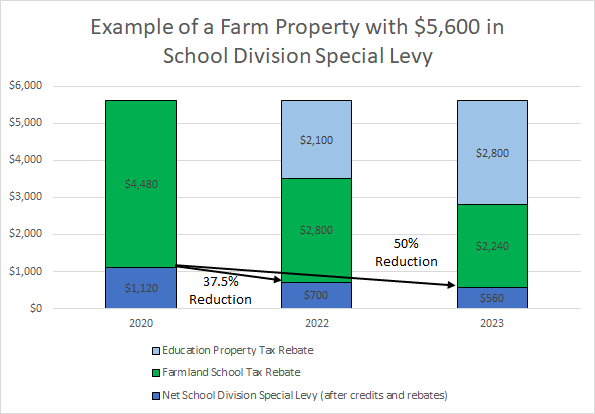

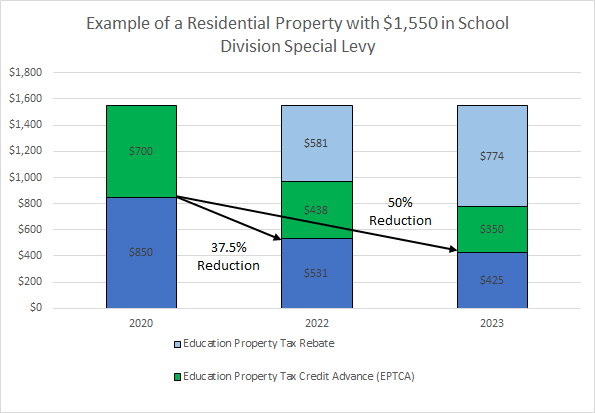

For 2022, owners of residential and farm properties will receive a 37.5 per cent rebate of the school division special levy payable. This will increase to 50 per cent in 2023. Residential properties include single dwelling units, condos and multiple unit dwellings.

The Education Property Tax Rebate will be based on the school division special levy before the Education Property Tax Credit Advance.

The examples below demonstrate that residential and farm property owners will be paying 37.5 per cent less in education property taxes in 2022 compared to 2020, as illustrated below:

Other properties

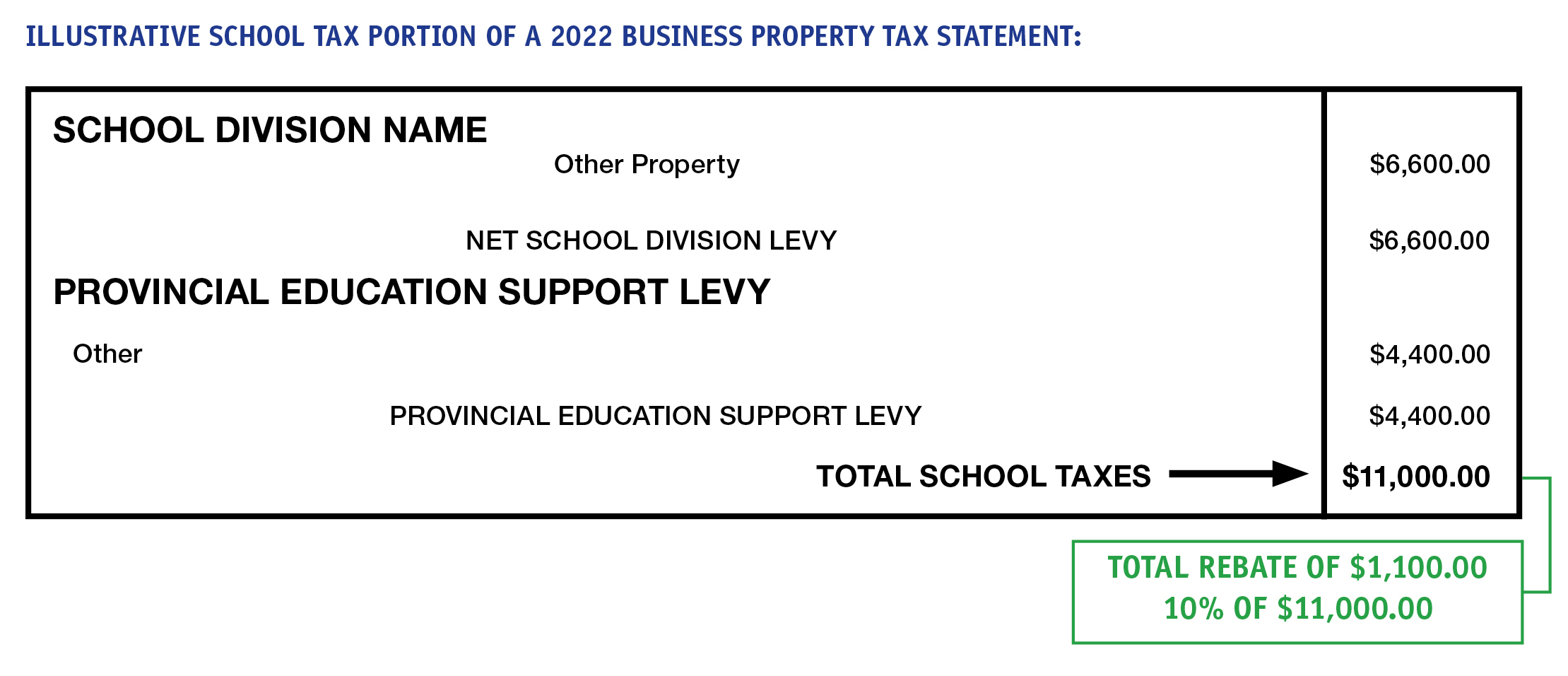

Owners of other properties (such as commercial, industrial, railway, institutional, pipelines and designated recreational) will receive a 10% rebate of the total of both the school division special levy and the education support levy payable.

Rebate Calculator

Questions and Answers

When can I expect my Rebate?

Rebates are sent out when Municipal Taxes are due.

| VILLAGE OF DUNNOTTAR | 2022-06-30 |

| CITY OF WINNIPEG | 2022-06-30 |

| CITY OF BRANDON | 2022-06-30 |

| TOWN OF STE. ANNE | 2022-07-29 |

| TOWN OF ALTONA | 2022-07-29 |

| CITY OF SELKIRK | 2022-07-29 |

| CITY OF PORTAGE LA PRAIRIE

|

2022-07-29 |

| RM OF VICTORIA BEACH | 2022-07-31 |

| CITY OF DAUPHIN | 2022-07-31 |

| TOWN OF SWAN RIVER | 2022-07-31 |

| RM OF GIMLI | 2022-08-31 |

| TOWN OF TEULON | 2022-08-31 |

| TOWN OF BEAUSEJOUR | 2022-08-31 |

| TOWN OF CARMAN | 2022-08-31 |

| CITY OF MORDEN | 2022-08-31 |

| TOWN OF SNOW LAKE | 2022-08-31 |

| TOWN OF THE PAS | 2022-08-31 |

| CITY OF WINKLER | 2022-08-31 |

| TOWN OF WINNIPEG BEACH | 2022-08-31 |

| LGD OF PINAWA | 2022-08-31 |

| RM OF ALEXANDER

|

2022-09-01 |

| RM OF LAC DU BONNET

|

2022-09-16 |

| RM OF MACDONALD

|

2022-09-24 |

| TOWN OF LAC DU BONNET

|

2022-09-25 |

| RM OF PORTAGE LA PRAIRIE | 2022-09-28 |

| RM OF THOMPSON

|

2022-09-28 |

| MUNICIPALITY OF BIFROST-RIVERTON | 2022-09-29 |

| RM OF BROKENHEAD | 2022-09-29 |

| RM OF CARTIER | 2022-09-29 |

| RM OF CORNWALLIS | 2022-09-29 |

| RM OF EAST ST. PAUL | 2022-09-29 |

| RM OF GREY | 2022-09-29 |

| RM OF LA BROQUERIE | 2022-09-29 |

| MUNICIPALITY OF NORTH CYPRESS-LANGFORD | 2022-09-29 |

| MUNICIPALITY OF NORTH NORFOLK | 2022-09-29 |

| RM OF ROSSER | 2022-09-29 |

| MUNICIPALITY OF KILLARNEY-TURTLE MOUNTAIN | 2022-09-29 |

| RM OF WEST ST. PAUL | 2022-09-29 |

| TOWN OF ARBORG | 2022-09-29 |

| TOWN OF NIVERVILLE | 2022-09-29 |

| TOWN OF MINNEDOSA | 2022-09-29 |

| TOWN OF NEEPAWA | 2022-09-29 |

| CITY OF STEINBACH | 2022-09-29 |

| TOWN OF STONEWALL | 2022-09-29 |

| MUNICIPALITY OF MINITONAS-BOWSMAN | 2022-09-29 |

| CITY OF THOMPSON

|

2022-09-29 |

| MUNICIPALITY OF BOISSEVAIN-MORTON | 2022-09-30 |

| MUNICIPALITY OF SWAN VALLEY WEST | 2022-09-30 |

| RM OF HEADINGLEY | 2022-09-30 |

| GILBERT PLAINS MUNICIPALITY | 2022-09-30 |

| TOWN OF MORRIS | 2022-09-30 |

| RIVERDALE MUNICIPALITY | 2022-09-30 |

| RM OF MOUNTAIN | 2022-09-30 |

| LGD OF MYSTERY LAKE | 2022-09-30 |

| TOWN OF GRAND RAPIDS | 2022-09-30 |

| RM OF ST. FRANCOIS XAVIER | 2022-10-03 |

| TOWN OF CARBERRY

|

2022-10-03 |

| RM OF MORRIS

|

2022-10-25 |

| MUNICIPALITY OF WESTLAKE-GLADSTONE

|

2022-10-28 |

| RM OF ELLICE-ARCHIE | 2022-10-31 |

| RM OF ARGYLE | 2022-10-31 |

| RM OF OAKVIEW | 2022-10-31 |

| MUNICIPALITY OF BRENDA-WASKADA | 2022-10-31 |

| MUNICIPALITY OF GRASSLAND | 2022-10-31 |

| MUNICIPALITY OF CLANWILLIAM-ERICKSON | 2022-10-31 |

| RM OF COLDWELL | 2022-10-31 |

| RM OF DAUPHIN | 2022-10-31 |

| RM OF DUFFERIN | 2022-10-31 |

| MUNICIPALITY OF TWO BORDERS | 2022-10-31 |

| RM OF ELTON | 2022-10-31 |

| MUNICIPALITY OF ETHELBERT | 2022-10-31 |

| MUNICIPALITY OF EMERSON-FRANKLIN | 2022-10-31 |

| RM OF HANOVER | 2022-10-31 |

| MUNICIPALITY OF GLENELLA-LANSDOWNE | 2022-10-31 |

| RM OF LAKESHORE | 2022-10-31 |

| MUNICIPALITY OF LOUISE | 2022-10-31 |

| MUNICIPALITY OF MCCREARY | 2022-10-31 |

| RM OF MONTCALM | 2022-10-31 |

| MOSSEY RIVER MUNICIPALITY | 2022-10-31 |

| MUNICIPALITY OF OAKLAND-WAWANESA | 2022-10-31 |

| RM OF MINTO-ODANAH | 2022-10-31 |

| MUNICIPALITY OF PEMBINA | 2022-10-31 |

| RM OF PIPESTONE | 2022-10-31 |

| MUNICIPALITY OF RHINELAND | 2022-10-31 |

| RM OF RITCHOT | 2022-10-31 |

| CARTWRIGHT-ROBLIN MUNICIPALITY | 2022-10-31 |

| RM OF ROCKWOOD | 2022-10-31 |

| RM OF ROSEDALE | 2022-10-31 |

| RM OF ST. ANDREWS | 2022-10-31 |

| RM OF STE. ANNE | 2022-10-31 |

| RM OF ST. LAURENT | 2022-10-31 |

| MUNICIPALITY OF ROBLIN | 2022-10-31 |

| RM OF YELLOWHEAD | 2022-10-31 |

| RM OF SIFTON | 2022-10-31 |

| MUNICIPALITY OF GLENBORO-SOUTH CYPRESS | 2022-10-31 |

| MUNICIPALITY OF NORFOLK TREHERNE | 2022-10-31 |

| RM OF SPRINGFIELD | 2022-10-31 |

| RM OF STANLEY | 2022-10-31 |

| RM OF PRAIRIE LAKES | 2022-10-31 |

| RM OF TACHE | 2022-10-31 |

| RM OF VICTORIA | 2022-10-31 |

| RM OF WALLACE-WOODWORTH | 2022-10-31 |

| RM OF WHITEHEAD | 2022-10-31 |

| RM OF WHITEMOUTH | 2022-10-31 |

| MUNICIPALITY OF DELORAINE-WINCHESTER | 2022-10-31 |

| RM OF WOODLANDS | 2022-10-31 |

| HAMIOTA MUNICIPALITY | 2022-10-31 |

| ROSSBURN MUNICIPALITY | 2022-10-31 |

| VILLAGE OF ST. PIERRE-JOLYS | 2022-10-31 |

| MUNICIPALITY OF STE. ROSE | 2022-10-31 |

| PRAIRIE VIEW MUNICIPALITY | 2022-10-31 |

| TOWN OF MELITA | 2022-10-31 |

| MUNICIPALITY OF RUSSELL-BINSCARTH | 2022-10-31 |

| MUNICIPALITY OF SOURIS-GLENWOOD | 2022-10-31 |

| RM OF ALONSA | 2022-10-31 |

| RM OF ARMSTRONG | 2022-10-31 |

| RM OF KELSEY | 2022-10-31 |

| RM OF FISHER | 2022-10-31 |

| MUNICIPALITY OF HARRISON PARK | 2022-10-31 |

| RM OF PINEY | 2022-10-31 |

| RM OF REYNOLDS | 2022-10-31 |

| RM OF STUARTBURN | 2022-10-31 |

| TOWN OF LYNN LAKE | 2022-10-31 |

| RM OF DE SALABERRY | 2022-10-31 |

| GRANDVIEW MUNICIPALITY | 2022-10-31 |

| MUNICIPALITY OF LORNE | 2022-10-31 |

| RM OF ROLAND | 2022-10-31 |

| RM OF ST. CLEMENTS | 2022-10-31 |

| RM OF RIDING MOUNTAIN WEST | 2022-10-31 |

| RM OF WEST INTERLAKE | 2022-10-31 |

| TOWN OF POWERVIEW - PINE FALLS | 2022-10-31 |

| TOWN OF LEAF RAPIDS | 2022-10-31 |

| TOWN OF VIRDEN | 2022-10-31 |

| TOWN OF CHURCHILL | 2022-10-31 |

| RM OF GRAHAMDALE | 2022-10-31 |

| TOWN OF GILLAM | 2022-10-31 |

| CITY OF FLIN FLON | 2022-12-31 |

Overview

The Education Property Tax Rebate is a rebate on school taxes provided to owners of property in Manitoba. It implements Manitoba's commitment under the $2,020 Tax Rollback Guarantee to begin phasing out education property taxes.

Eliminating education property taxes will provide Manitobans with much needed tax relief. Manitoba is the only province to impose locally determined education property taxes. The phasing out of these taxes will put Manitobans on an equal footing with other provinces that fund education from general revenues.

Residential and farm property owners will receive a rebate of 37.5% of their gross education property tax payable in 2022, and 50% in 2023 (up from 25% in 2021).

Other property owners (such as commercial, industrial, institutional, railways, pipelines and designated recreational) will receive a rebate of 10% of their education property taxes payable in 2022 and 2023.

Residential and farm property owners will see the Education Property Tax Rebate calculated on the school division special levy and community revitalization levy, prior to any tax credits or rebates.

Other property owners will see the Education Property Tax Rebate calculated on the total of the school division special levy, education support levy, and community revitalization levy.

Education property taxes are a tax deductible expense for businesses, and businesses also benefit by receiving a 10% rebate on both the school division special levy and the education support levy.

Tax Credits and Rebates

All existing education property tax credits and rebates remain in place but they are proportionally adjusted to ensure that all residential and farm properties see a net reduction in school taxes of 37.5%.

This is because the Education Property Tax Rebate is based on gross school taxes payable, before the tax credits are calculated.

As part of the Education Property Tax Rebate, other tax credits and rebates will be adjusted proportionately as follows:

Tax Credit and Rebate Amounts |

||||

|

2020 |

2021 |

2022 |

2023 |

Education Property Tax Credit and Advance |

Up to $700 |

Up to $525 |

Up to $438 |

Up to $350 |

Seniors School Tax Rebate |

Up to $470 |

Up to $353 |

Up to $294 |

Up to $235 |

Seniors Education Property Tax Credit |

Up to $400 |

Up to $300 |

Up to $250 |

Up to $200 |

Farmland School Tax Rebate |

Up to 80% of school tax to |

Up to 60% of school tax to |

Up to 50% of school tax to |

Up to 40% of school tax to |

Note: Farm property owners must still apply for the Farmland School Tax Rebate.

The Education Property Tax Credit Advance will be adjusted from a maximum of $525 in 2021 to $437.50 in 2022. Along with the Education Property Tax Rebate, this ensures that all homeowners, regardless of whether or not they receive the Education Property Tax Credit Advance will see a 37.5% reduction in net education property tax paid.

All property owners will receive the Education Property Tax Rebate. If you currently do not pay education property tax on your property assessment because of existing tax credits, the Education Property Tax Rebate will be cash in hand when your property tax is due and you will continue to receive benefits that will fully offset school taxes.

Farm property owners will still have to apply for the Farmland School Tax Rebate (FSTR) but the percentage eligible and the maximum amount will be decreased proportionately by 37.5% relative to 2020. The percentage of education property tax on farm land eligible for the FSTR decrease from 60% in 2021 to 50% in 2022 and the maximum FSTR will decrease from $3,750 in 2021 to $3,125 in 2022. The 37.5% Education Property Tax Rebate applies to education property taxes on farm land and on farm buildings.

Landlords and Renters

Up until this year, homeowners and residential renters have qualified for the same credit, the Education Property Tax Credit. In 2021, this credit provided renters with up to $525.

Commencing in 2022, the renters Education Property Tax Credit will become the Manitoba Residential Renters Tax Credit.

Like the Education Property Tax Credit, the Residential Renters Tax Credit will continue to be delivered through the annual personal income tax return and apply to principal residences. In addition, the credit will no longer be calculated based on 20 per cent of annual rent. Instead, the Residential Renters Tax Credit will be calculated on a monthly basis, on the same basis residential tenants pay rent.

Unlike the Education Property Tax Credit, which will continue to be adjusted as the Education Property Tax Rebate increases, the maximum annual amount of the Renters Credit will be fixed at $525.

As residential property owners, landlords will receive a 37.5% Education Property Tax Rebate in 2022, thereby lowering their operating costs. To help ensure that tenants benefit from these savings to landlords, legislation was passed in 2021 to set the annual rent guideline at 0% in 2022 and 2023.

Education Funding

The phasing out of education property taxes will not impact Manitoba's efforts to transform its education system into a modern, responsive and ambitious system that is classroom focused, student centered and parent friendly, or on its commitment to provide a guaranteed increase of over $1.6 billion in education funding over four years.

School division levies will continue to apply until the tax is eliminated. The Education Property Tax Rebate is funded 100% provincially and not through school division special levies.

General Costs and Education Property Tax Rebate Process

Total rebates are estimated at $350 million in 2022 and $453 million in 2023.

Property owners will be required to continue to pay their education property taxes on their property tax statement. The reduction is being provided by the Education Property Tax Rebate, which will be received by property owners before their property taxes are due.

Cheques ensure that property owners are aware that the Manitoba government is refunding 37.5% or 10% of their education property taxes back in 2022.

Also, by not reducing education property taxes directly on the property tax bill ensures school divisions continue to receive school taxes as revenue, which facilitates their budget planning.

Property owners will receive the Education Property Tax Rebate cheque in the same month that municipal property taxes are due and after property tax statements are mailed by the local government.

A request for a replacement cheque can be made by contacting Manitoba Government Inquiries at 1-866-626-4862.

In situations where property is owned by multiple parties, property owners should verify with those parties if they received the Education Property Tax Rebate.

If no property owners have received a cheque, a request should be made by contacting Manitoba Government Inquiries at 1-866-626-4862.

A request for the cheque to be validated in the name of the estate or to be re-issued in the name of a surviving property owner can be made returning the original cheque with accompanying proof of the deceased to:

Manitoba Finance

Manitoba Tax Assistance Office

110A - 401 York Avenue

Winnipeg MB R3C 0P8

Please contact your financial institution regarding what documentation is needed for the cheque to be deposited.

If the financial institution cannot accept the cheque, a request for a replacement cheque can be made by returning the original cheque and providing proof of change of name to:

Manitoba Finance

Manitoba Tax Assistance Office

110A - 401 York Avenue

Winnipeg MB R3C 0P8

Cheques will be mailed automatically - no application is required by property owners.

Direct deposit would require property owners to provide the Province with banking information, which would delay payments.

More Information

Manitoba Government Inquiry

204-945-3744

1-866-MANITOBA

(1-866-626-4862)